Credit History

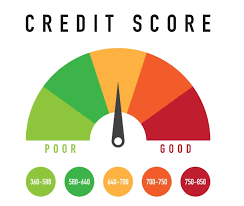

According to the Government of Canada, credit history records the repayment history of credit cards, loans, and lines of credit. Your credit history helps determine your credit score. Therefore, it is important to be cautious about how you use and manage your credit.

How to Check Your Credit Score

The federal government says it’s important to check your credit score so you can understand your financial situation. Both Equifax and TransUnion offer credit scores for a fee.

How to Improve Your Credit Score

The Government of Canada states that if you manage your credit responsibly, your credit score will increase, and if it is difficult to manage your credit properly, your credit score will decrease.

Here are some tips from the Canadian government for improving your credit score:

- By taking a credit card and using it to spend, credit history can be established. 3 You can access and review your credit history by obtaining a credit report from a credit bureau. You can request a free copy of your credit report from Equifax and Transunion every 12 months without affecting your credit score. You can request reports by phone, email, and online.

- Try to pay your bills on time and in full to maintain a good repayment record and improve your score. If you cannot afford to pay the full bill, try to make the minimum payment. If you think you are having trouble paying your bills, contact your lender.

- Don’t apply for or change credit cards too frequently. Do your best to control your total debt and don’t let small debts add up.

Here’s our tip: try to get the most out of your credit card and make sure you pay on time. One way to help you keep your payments on time is to set up pre-authorized payments from bank accounts to credit cards.

Watch this video to easily understand its detailed instructions:

What is credit limit utilization or debt-to-credit ratio?

According to Equifax, your debt-to-credit ratio (also known as your credit limit utilization ratio) is the ratio of your debt to your credit limit. Your debt-to-credit ratio is important because a high ratio may indicate that you are a riskier borrower. 5 This is because lenders perceive borrowers with higher credit line utilization as riskier.

For example, let’s say you have multiple credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio will be 70%.

According to the Government of Canada, it is recommended to keep credit limit utilization for credit cards, loans, and credit facilities at 35% or less.

How to maintain your credit score

One way to maintain your credit score is to try to keep your credit limit utilization within the aforementioned 35% range. Calculate the sum of all credit limits and multiply by 35%. Ideally, this is the amount you should try to avoid exceeding when borrowing or using a line of credit.

Avoid applying for too many credit loans

There are some downsides to having too many credit cards. You might be tempted to spend more with these credit cards.

You should also avoid taking out too many loans, having too many credit cards, and applying for too many credit checks in a short period, according to the federal government. This is because it can also negatively affect your credit score.

Do not exceed your credit limit

Avoid exceeding your credit limit. If you overspend, your credit score may decrease.

Overall, having a good credit score can help you improve your financial confidence and security. So, congratulations on taking your first step to understanding how credit scoring works and how to improve it!