A Fixed indexed annuity for retirement is an insurance agreement that offerS you with income in retirement. With a fixed index income, your expenses are bear on the proceeds of a stock bazaar index, akin to the S&P 500 or the Dow Jones manufacturing average. Unlike straight investing in the stock market, you’re usually sheltered against losses—in swap, your total returns will be partial, and your contract may charge extra fees.

How Does a Fixed Index Annuity Work?

A fixed index annuity offers steady payments that are based on the presentation of an underlying index. Fixed index pension offer some of the benefit of investing in index funds, and may track the Russell 2000 , the S&P 500, the Nasdaq, or the Hang Seng. Unlike index funds, fixed index pensions are usually protected against loss of principal. This means you won’t lose any of the cash you put into a fixed index annuity.

This defense against losses, however, comes at a price. You won’t receive the precise return of the market index. Instead, the pension will limit both your likely gains and your losses. This scheme makes an indexed annuity safer than investing directly in the market, although investing in a fixed income is more multifaceted than investing in an index fund.

Fixed Index Annuity Returns

A fixed index annuity will most probable limit your annual gains as well as your yearly losses. Some of the common components for limiting gains or losses comprise:

• Loss floor. A Fixed indexed annuity for retirement may limit your losses, still in a bad year for the market. It’s general for the floor to be 0%, so worst case you just break even in a slump

• Minimum return. A fixed index income might reimburse out a small assured notice rate or return, so no matter how the market index performs you create at least some cash.

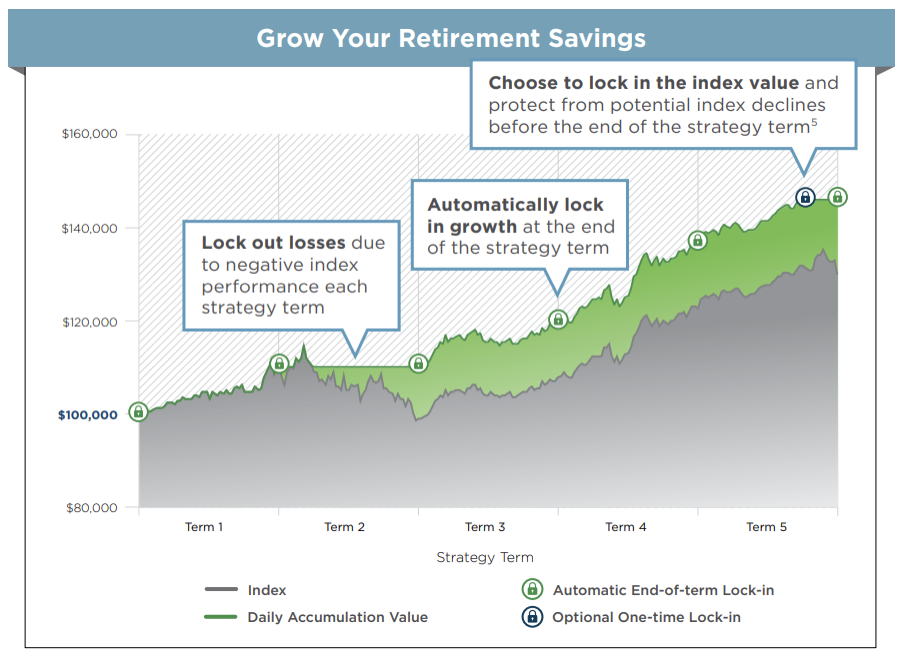

• Adjusted value. Your fixed index annuity could use a familiar value method to protect against losses. This means the income commerce would infrequently regulate the least worth of your contract based on the returns you’ve previously earned. This locks in your increases so you can no longer fall less this threshold.

• Participation rate. Your annuity company may choose to limit your gains throughout a participation rate. The partaking rate is the percentage of your cash that’s really entitled to earn market returns. For example, if the contribution rate is 50%, you would obtain half of the index’s returns. If the market index return is 8%, your equilibrium would only grow by 4%.

• Spread/margin/asset fee. Your Fixed indexed annuity for retirement company could too deduct a spread/margin/asset payment from your return each year. If their fee is 3% and your return is 8%, your cash would only grow by 5%. A fixed index annuity contract may staple on one or more of these features. Be sure to intimately study a contract to see precisely how your gains and losses will be incomplete.